tax service fee closing cost

Tax breaks ease the cost of mortgage. Buying a home comes with tax benefits but its important to know what is and isnt tax deductible.

/shutterstock_299702729_closing_costs-5bfc3181c9e77c0026317a8f.jpg)

Understanding Mortgage Closing Costs

If you are married and your spouse is covered by a retirement plan at work and you arent and you live with your spouse or file a joint return your deduction is phased out if your modified AGI is more than 204000 up from 198000 for 2021 but less than 214000 up from 208000 for 2021.

. NW IR-6526 Washington DC 20224. 1421 Indian car makers propose tax cut on imports in trade deal with Britain. NW IR-6526 Washington DC 20224.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. 0749 UK nurses union to go on strikes as cost of living energy crisis worsen. Effective October 28 2021 a user fee of 67 was established for persons requesting the issuance of an estate tax closing letter ETCL.

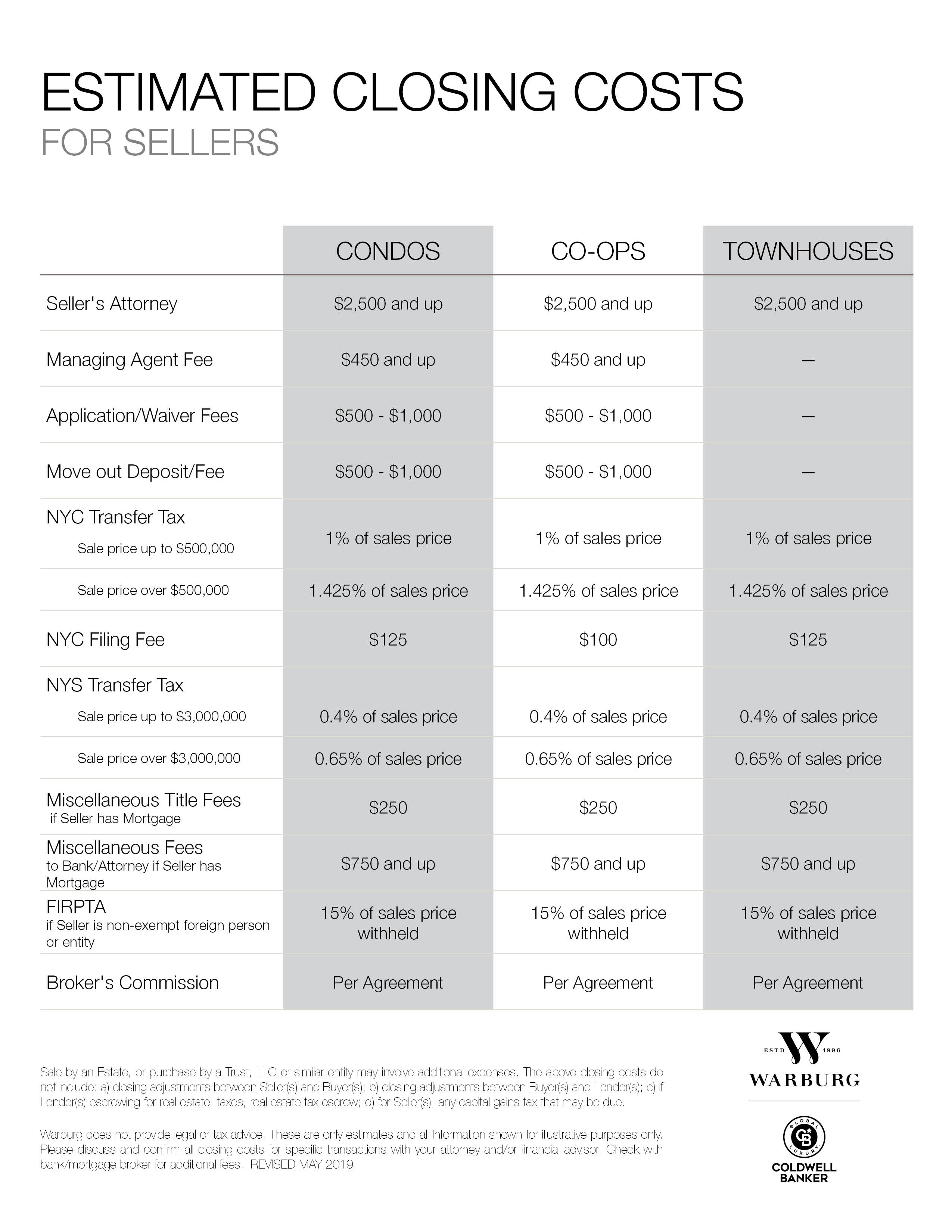

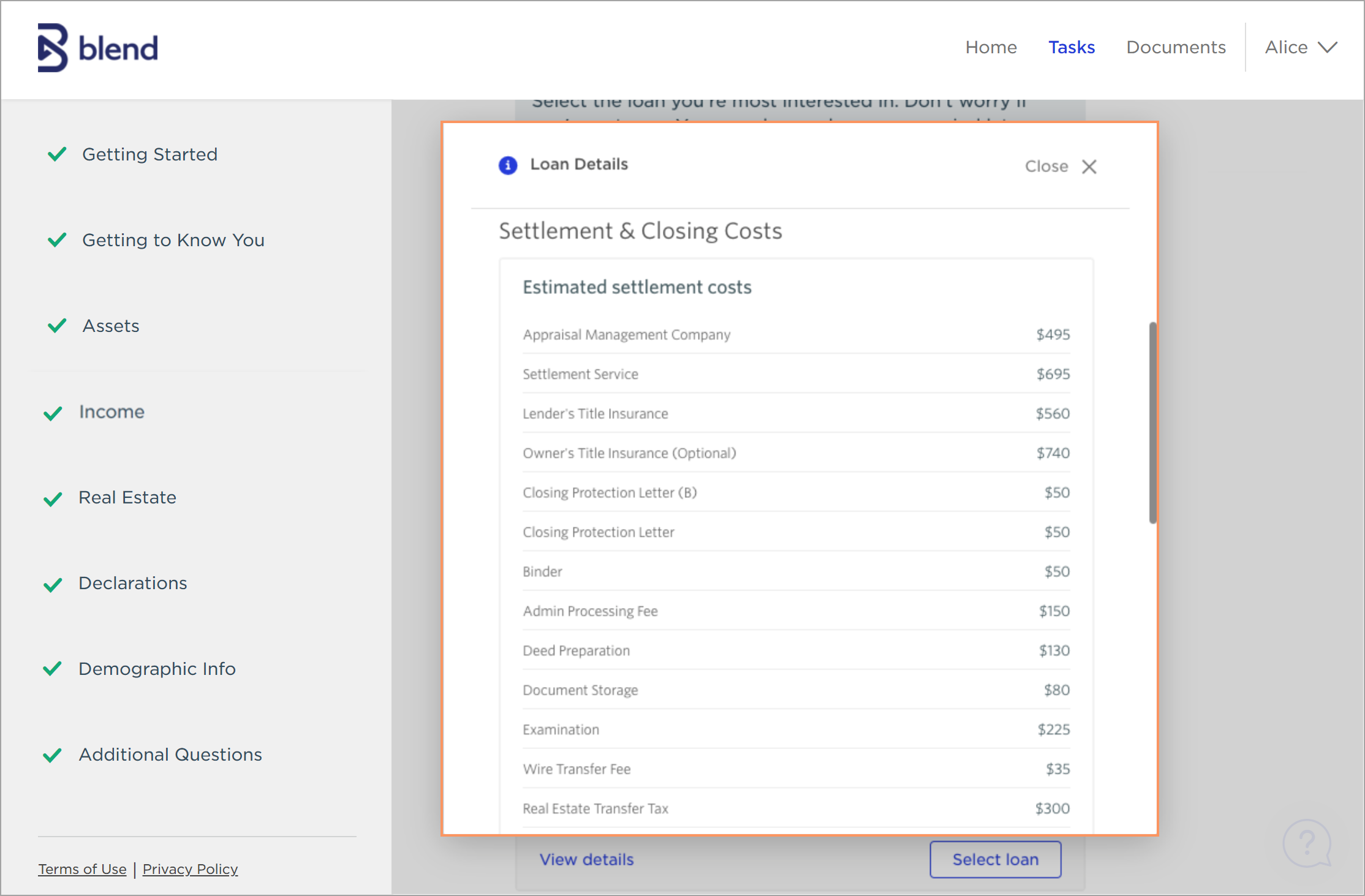

Tax service fee Title fees and taxes Lenders title insurance policy Owners title insurance policy. Both buyers and sellers may be subject to various closing costs. Laying the blame with Liz Trusss disastrous premiership Labour.

0722 Indonesia urges G20 parliaments to strengthen ties for economic recovery. Youll likely pay a specialty inspection service and the cost is roughly 100. A unit fee for the delivery of a service such as a 5 fee charged for every 1000 gallons of water you use.

Set finance the funding fee to No and deduct that number from your cash due at closing to get your actual closing costs. The cost of domestic labor. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Say you bought a property for 100000 and the day you die its worth 1 million. The cost of buying property including principal payments on a mortgage. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

We welcome your comments about this publication and suggestions for future editions. Unrivaled access premier storytelling and the best of business since 1930. If youd sold it while still alive the cost basis would be 100000 and youd owe capital gains taxes on a 900000 profit.

If you built your home your cost includes most closing costs paid when you bought the land or settled on your mortgage. The points are deductible as interest as long as the cash you paid at closing via your down payment is equal to or greater than the points. Families are paying more than 530 extra for their mortgage than at this time last year analysis by the Labour Party shows.

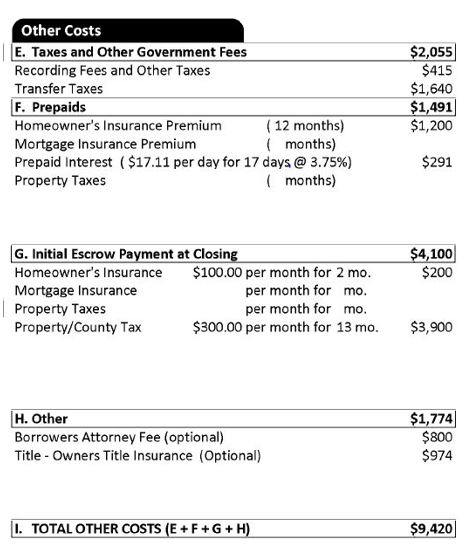

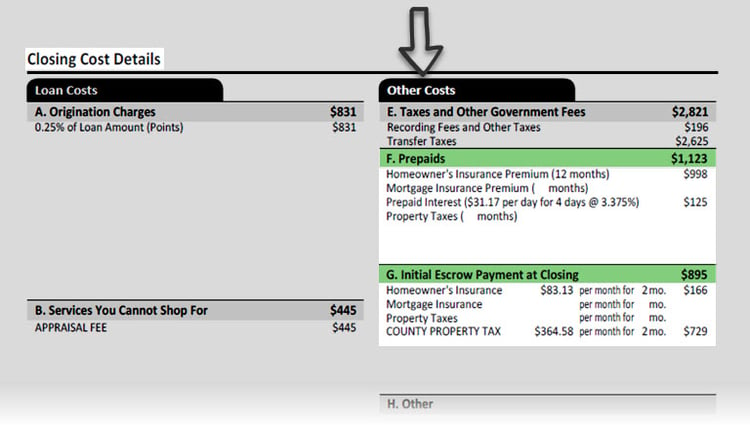

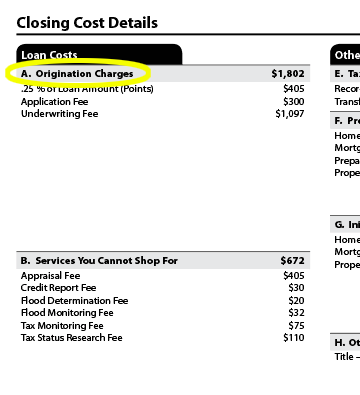

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Closing costs are the fees and charges in excess of the purchase price of the property due at the closing of a real estate transaction. Pacific Time on August 31 or your payment is United States Postal Service postmarked after August 31.

Every state has a different minimum coverage requirement making auto insurance coverage more expensive in some states than others but they remain lower. To be considered timely payments made through EFTPS must be completed no later than 8 pm. For example if you paid two points 2 on a 300000 mortgage6000you can deduct the points as long as you put at least 6000 of your own cash into the.

A service fee service charge or. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. A transfer tax is a one-time tax or fee imposed by a state county or local government whenever a property changes hands.

Many cable TV and telephone companies including ATT include a regulatory-cost recovery fee in the bill each month of around 3. But not the most cost-effective way to buy. Starting the first day of the third month after the delinquency date we will also impose an.

After a municipality issues a tax lien. Youll have to pay a VA funding fee at closing. After you die the cost basis for tax purposes jumps to 1 million.

Pursuant to California Revenue and Taxation Code Section 2922 we will impose a 10 percent penalty plus a 20 Notice of Enforcement cost if we receive your payment after 500 pm. Insurers use actuarial science to determine the rates which involves statistical analysis of the various characteristics of drivers. Learn whether your loan origination fee is tax deductible.

One of the lesser known benefits of becoming a homeowner is the tax deductions you will receive. A free tax service offered by the Department of Defense through Military OneSource. If you do not want to finance the funding fee then set the financing option to No.

However knowing what homebuyer costs qualify for a tax deduction can be confusing. The summary of responses and next steps was published in November 2020 which stated that government would review options to tackle the high cost to consumers of claiming tax refunds. Find in-depth news and hands-on reviews of the latest video games video consoles and accessories.

It can cost between 05 and 36 of the loan amount depending on the details of. Be informed and get ahead with. The automobile insurance market in the United States is a 308 billion US dollar market.

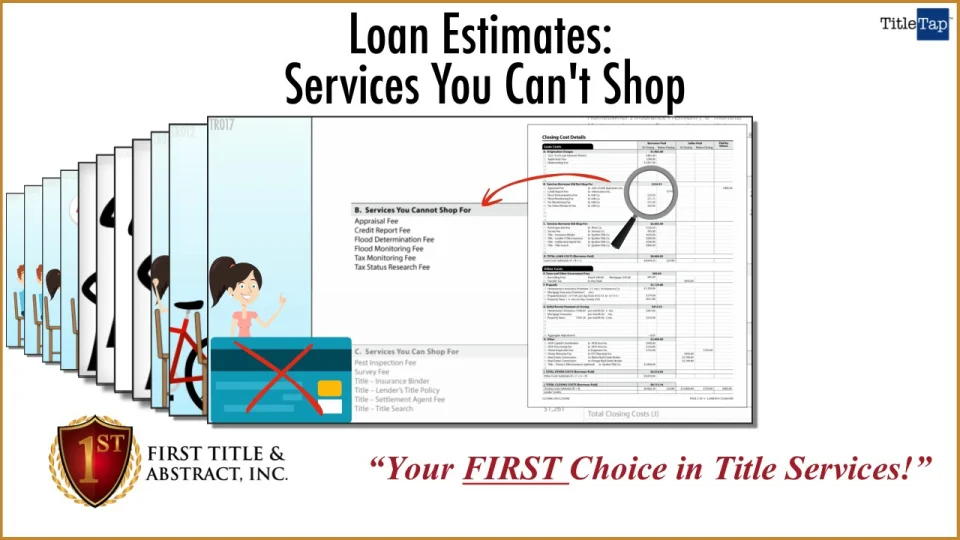

A title company or attorney collects a variety of fees in the course of handling the purchase of a house at a closing. Mortgage loan basics Basic concepts and legal regulation. These may include fees for tax service flood.

1728 OYO elevates two senior execs in service experience and revenue functions. Get all the latest India news ipo bse business news commodity only on Moneycontrol. Modified AGI limit for certain married individuals increased.

A tax lien is a legal claim that a local or municipal government places on an individuals property when the owner has failed to pay a property tax debt. Roll Funding Fee Into Loan. 3 min read Oct 21 2022.

The information provided above regarding approximate cost of closing fees approximate total funds needed to close and the approximate total monthly payment collectively referred to as approximate loan cost illustration are only. If you were 10 or more disabled while in service your funding fee can be waived. EFTPS is a free service of the Department of the Treasury.

Estate tax closing letter fee.

Isn T The Other Guy Supposed To Pay Those Closing Costs

How Much Are Closing Costs For Sellers Zillow

Buyer Closing Costs Explained The Arlington Expert

Texas Customary Closing Costs Doma

Closing Costs Archives Naples Title Company Marco Island Title Company First Title Abstract Inc

2018 Closing Costs In Meridian Idaho Meridian Idaho Houses

Nfcu 0 Down No Pmi Closing Cost Sticker Shock Page 3 Myfico Forums 4899666

Who Pays Closing Costs Including Title Insurance Ohio Real Title

Lo Toolkit Fees Blend Help Center

Understanding Closing Costs Sirva Mortgage

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Closing Costs In California Explained

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Closing Costs Explained How Much Are Closing Costs Zillow

The Loan Estimate And Closing Disclosure What They Mean Nerdwallet

Va Loans They Re Not The Spawn Of Satan Emily Caryl Ingram

Donna Hennessey The Most Common Closing Costs Explained Mortgages Closingcosts Homebuyingnewhampshire Facebook